Industrial Space Vacancy Rates Surge to 5.3% in LA County, Q2 2024

Demand Shifts Market Dynamics with Vacancies Highest in More than A Decade

MARKET OVERVIEW

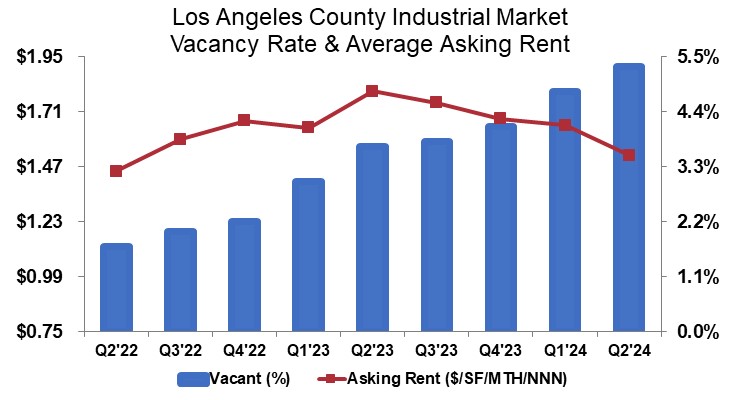

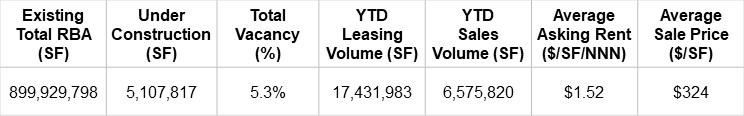

In Q2 2024, the industrial space vacancy rate in L.A. County rose, contributing to a 160-bps increase year-over-year, now standing at 5.3%, which is 50 basis points higher than the first quarter of 2024. Over the past two quarters, L.A. County added approximately 3.3 million square feet of completed construction to the market, while absorption resulted in a negative 8.3 million square feet during the same timeframe, indicating a shift in the industrial market’s trajectory.

The amount of industrial space under construction decreased by 23.9% compared to last year and dropped 20.8% from the prior quarter. The rate of completed construction almost tripled quarter-over-quarter and increased by 48.0% year-to-date compared to mid-year 2023 as developers raced to market, completing warehouse space in the pipeline to capture the now waning demand spurred by e-commerce’s urgent need for capacity. The once double-digit rent growth, the primary driver for new construction, has now turned into a double-digit rent decline, with the average asking rent in Q2 dropping by 15.6% from the previous year to $1.52/SF triple net, down 7.9% from Q1 2024.

Los Angeles County Industrial Market Q2 2024 Statistics:

Sales volume declined by 67.0% quarter-over-quarter and 33.5% year-to-date compared to the second half of last year, totaling approximately 6.6 million square feet at the end of Q2 2024. The average sale price per square foot dipped 2.5% quarter-over-quarter to $324, remaining 10.1% above last year’s level. While leasing volume rose 8.0% quarter-over-quarter, closing the first half of 2024 with approximately 17.4 million square feet leased, it declined by 6.0% year-to-date.

TRENDS TO WATCH

Lower leasing velocity remains a concern for landlords while providing ammunition for tenants to negotiate favorable deals. Nevertheless, an increase in the number of options for e-commerce warehousing of goods will drive the market as companies seek out flexible solutions to meet evolving demand. Companies that actively reduced excess warehouse space has been backed-filled resulted in a decrease in the amount of vacant sublease space on the market, down by 6.0% from the first quarter of 2024, however it remains 25.9% higher than Q2 2023, totaling approximately 5.6 million square feet which is still just shy of the all-time high reached last quarter. This abundance of industrial space indicates that companies with warehousing requirements will have a variety of options as cargo coming through the ports remains up in pace. According to the latest figures from the Ports of Los Angeles and Long Beach, inbound loaded TEU cargo volumes combined—a significant driver of warehouse space demand in L.A. County—increased by 17% year-to-date as of May 2024.

While the growth rate is expected to be lower, prices will continue their descent as interest rates remain elevated, affecting industrial building sales—though quality space still commands a premium. Sales dollar volume plummeted 69.5% quarter-over-quarter, with the year-to-date total down 0.7% from last year’s figure. The median sale price per square foot, compared to the average, fell by 1.5% quarter-over-quarter, and registered a lower year-over-year increase of 5.0%, reflecting the impact weighing on the market. The combination of elevated interest rates and slowing demand will continue to exert downward pressure on pricing heading into the second half of the year, as opportunities are seized in the marketplace.