Third Quarter 2024

Industrial Demand Slows as Inland Empire Vacancy Hits 8.1%

Vacancy reaches a new high, construction slows, and rents decline as market adjusts to moderating warehouse demand.

The growing availability of warehousing options is poised to invigorate the leasing market.

MARKET OVERVIEW

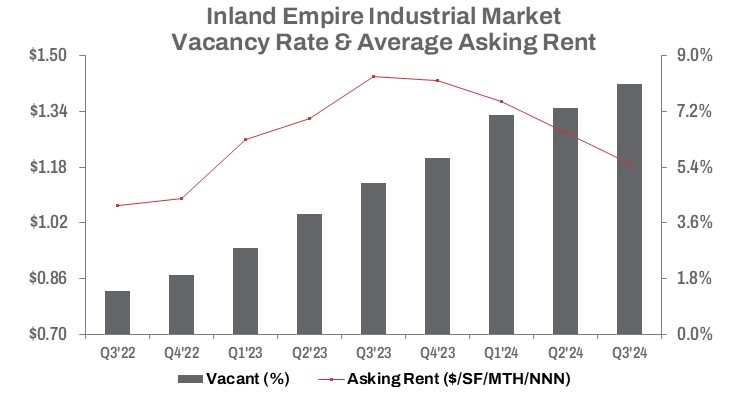

In Q3 2024, the Inland Empire’s industrial vacancy rate rose to 8.1%, increasing by 70 basis points quarter-over-quarter and 320 basis points year-over-year. Over the past three quarters, approximately 22.2 million square feet of completed construction entered the market, while net absorption, though positive, registered just 3.3 million square feet. This shift reflects a changing trajectory in the industrial market.

Completed construction increased by 45.9% year-to-date compared to Q3 2023, though it fell by 41.5% quarter-over-quarter, indicating fewer new construction starts as the demand for warehouse space moderates from the rapid expansion seen during e-commerce’s peak. The amount of industrial space under construction also declined, down 56.8% from last year and 12.8% from the previous quarter. Rent growth, once a key factor driving new construction, has begun to decelerate, with the average asking rent in Q3 dropping by 7.0% from the prior quarter to $1.19 per square foot on a triple net basis—a 17.4% decrease year-over-year.

Sale volume in Q3 dropped 17.7% from Q2 2024 and was down 24.5% year-to-date compared to the same period in 2023, totaling about 8.1 million square feet at the close of Q3. The median sale price per square foot dipped 1.7% quarter-over-quarter to $276, though it remains 7.5% above last year’s level. Leasing volume also declined 17.5% quarter-over-quarter, with approximately 11.5 million square feet leased by the end of Q3, while year-to-date leasing volume increased by 14.3%, surpassing 37 million square feet.

TRENDS TO WATCH

Shrinking lease and sale velocity will present a challenge while driving efforts to close deals. The expanding availability of warehousing options is set to boost the leasing market as companies seek adaptable solutions to meet shifting demand. Excess sublease space will continue seeking backfill opportunities, with the rate of newly vacated sublease space slowing to 0.8% from Q2 2024; however, the volume of sublease space remains 78.9% higher than Q2 2023, totaling approximately 13.1 million square feet—a record high. Although cargo flow through the ports remains steady, the abundance of industrial space provides ample options for warehousing needs. According to the latest data from the Ports of Los Angeles and Long Beach, inbound loaded TEU cargo volumes—a significant driver of warehouse demand in the Inland Empire—rose 21.4% year-to-date as of September 2024.

While growth rates are expected to taper off, prices will likely continue to decline amid elevated interest rates, impacting industrial building sales despite premium valuations for high-quality space. Sales dollar volume saw a 17.7% increase quarter-over-quarter, though the year-to-date total of 8.1 million square feet remains 24.5% below last year’s level. The median sale price per square foot at $276 reflects a 1.5% dip quarter-over-quarter, yet maintains a 7.5% increase year-over-year, highlighting the market’s response to fluctuating sales volume and prices. Elevated interest rates and cooling demand will likely continue to pressure pricing into the second half of the year, as market opportunities emerge.