L.A. County Commercial Real Estate Faces Summer Slowdown Amid Rising Vacancies and Mixed Rent Trends

Q2 2024: Vacancy Rates Rise, Rents and Sale Prices Drop Amid High Interest Rates, While Multifamily Sector Rents and Retail Sale Prices Increase Despite Higher Vacancies

Los Angeles County’s commercial real estate markets slowed in the first half of 2024, heading into the slow days of summer, with vacancy rates rising, rents and sale prices dropping, except for multifamily rents, which jumped back up quarter-over-quarter and compared to the second half of last year. Retail also saw an increase in the average sale price, while the average office asking rent resisted the market’s downward trend amid the office market’s doldrums.

The Federal Reserve has maintained interest rates at a 23-year high for nearly a year, following the initiation of an aggressive rate-hiking campaign in March 2022. While waiting for more evidence that inflation is heading toward 2%, the economy’s resilience has compelled the Federal Reserve to keep interest rates elevated. As the Federal Reserve continues its efforts to cool inflation by maintaining high interest rates this year, price pressures appear to be easing. Correspondingly, demand for commercial real estate has noticeably continued to wane in the second quarter of 2024. The high interest rates are dampening demand by increasing the cost of borrowing for businesses and consumers, a measure designed to tame inflation by slowing spending across the economy.

Multifamily

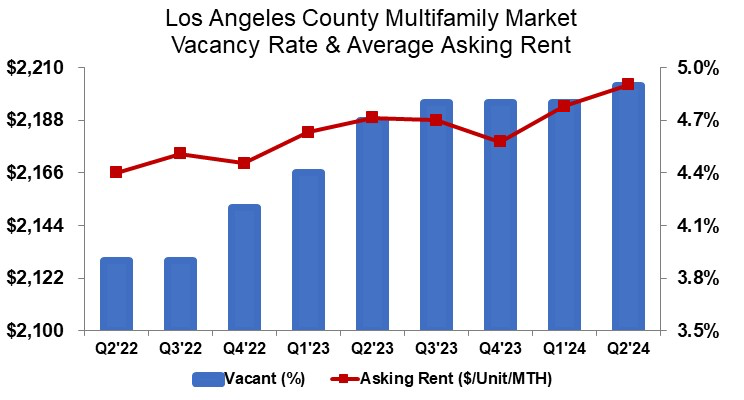

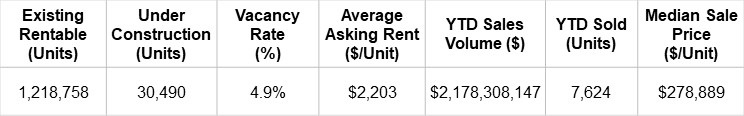

In Q2, the vacancy rate for multifamily units in Los Angeles County moved up 10 basis points quarter-over-quarter and 20 basis points year-over-year to 4.9% as new construction added approximately 6,300 units to the inventory year-to-date, causing vacancy to rise.

Newly completed units, mainly on the high end of the market, continue to contribute to a rise in the average asking rent per unit this quarter. The average rent, after a small decline at the end of last year, has once again increased – up four-tenths of a percentage point quarter-over-quarter and six-tenths of a percentage point year-over-year as 4,581 units were absorbed over the past two quarters. At $2,203 per unit per month, the average asking rent is now back up to a new record high in Los Angeles County for the average multifamily housing unit.

While rent is at an all-time high, construction costs, concerns about a slowing economy, elevated interest rates, and lower rent growth have impacted multifamily investment. Additionally, the ULA Tax, which has now been in place for a year, has had a negative impact on sales. Sale volume year-to-date is down 29.3% compared to last year at $2.2 billion, with the median sale price per unit down 5.1% to $278,889 and the number of units sold declining 1.9% over the same timeframe.

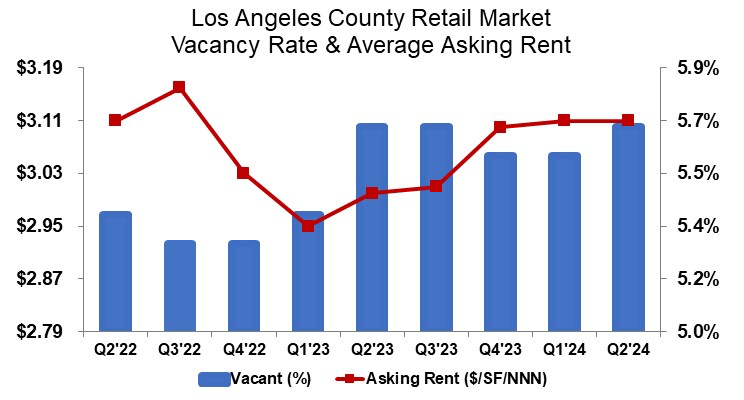

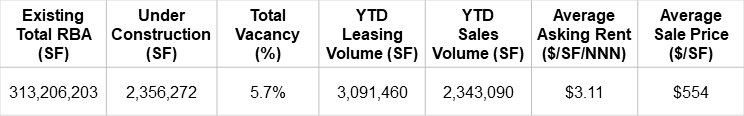

Retail

Retail’s pivot back to brick-and-mortar remained challenging. As bankruptcies continued to affect some retailers, the shedding of locations caused the vacancy rate to rise to 5.7% in Q2, up 20 basis points quarter-over-quarter and year-over-year. The average asking rent remained flat from the prior quarter at $3.11 per square foot triple net in Q2. While the average asking rent grew by 3.7% from last year, leasing volume saw a 9.7% decline year-to-date, totaling approximately 3 million square feet.

Despite retailers vacating prime locations, retail property investors see opportunities. The average sale price of $554 per square foot increased by 34.9% quarter-over-quarter and 66.5% year-over-year. However, sales volume year-to-date decreased by 41.4% compared to last year, totaling just over 2.3 million square feet. Interest rates are affecting sales, but investors are still looking to capture prime retail locations, willing to pay a premium.

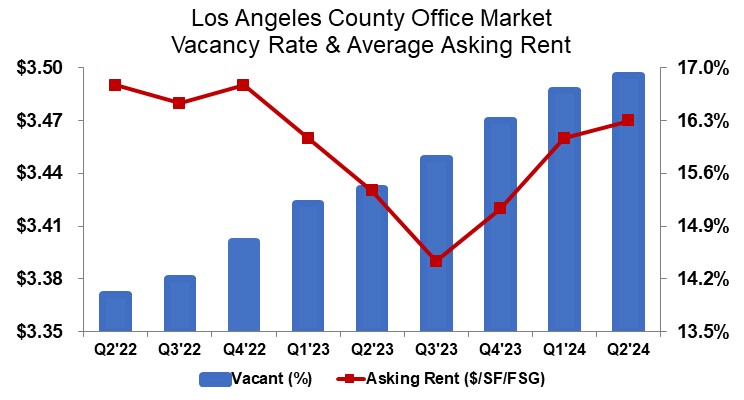

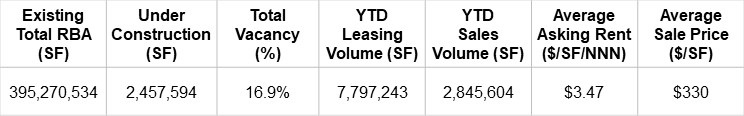

Office

The market for office space remained weak. As companies continued shedding excess space, the vacancy rate grew to 16.9% in Q2, up 20 basis points quarter-over-quarter and 150 basis points from Q2 2023. The average asking rent up 1-cent essentially remained flat quarter-over-quarter, up 4 cents from where it stood for the past four quarters to $3.47 per square foot full-service gross in Q2 2024. Persistently high asking rents continue to impact leasing volume, which saw a 16.1% decline year-to-date, totaling approximately 7.8 million square feet.

The availability of office space offered for sublease grew steadily, up 5.6% quarter-over-quarter and 5.8% year-over-year to more than 12.1 million square feet of sublease space on the market by the end of Q2. Available sublease space has ballooned 103% since Q2 2020 from the pandemic shutdown. As office space utilization continues to play out slowly through the office market, the amount of available office space offered remains elevated – at an all-time high of 78 million square feet.

Low demand in leasing office space led to a sell-off of office buildings in Q2, with some notable distressed building sales. However, sales volume of office buildings has plummeted year-to-date by 70.3% to more than 2.9 million square feet, with the average sale price dropping 38.0% from Q2 2023 to $330 per square foot.

Industrial

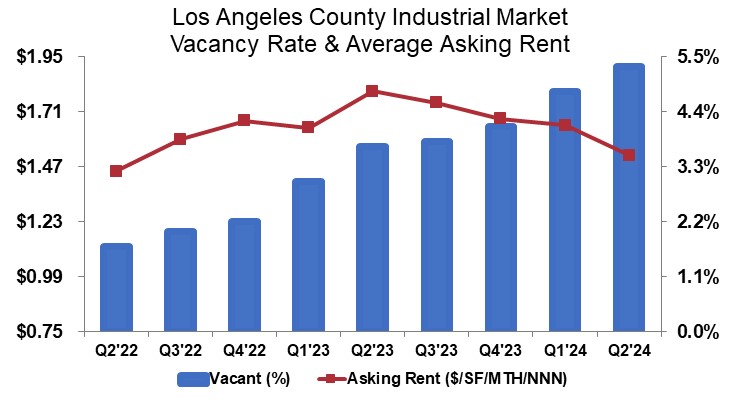

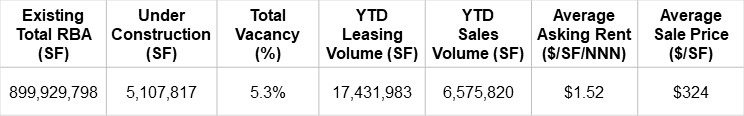

The vacancy rate for industrial space increased by 50 basis points from the previous quarter and by 160 basis points from the second quarter of last year, reaching 5.3% in Q2 2024. The average asking rent declined for the fourth consecutive quarter, dropping 7.9% quarter-over-quarter. This quarter, at $1.52 per square foot triple net, the average asking rent was 15.6% below last year’s level. Leasing volume also saw a 6.0% decline year-to-date, totaling approximately 17.4 million square feet.

While the increase in vacant industrial space provided more options for tenants at mid-year 2024, high prices and higher interest rates weakened sales of industrial buildings. Sales volume declined 67.0% quarter-over-quarter and 33.5% year-to-date compared to the second half of last year, totaling approximately 6.6 million square feet at the end of Q2 2024. The average sale price per square foot dipped 2.5% quarter-over-quarter to $324, remaining 10.1% above last year’s level.

Economic conditions caused a shift in Q2 2024. As the Federal Reserve combats inflation by maintaining high interest rates, increased borrowing costs have created challenges for commercial real estate. Los Angeles County’s commercial real estate markets are under ongoing pressure to adjust to these changes, impacting real estate values.