L.A. County’s Office Market Navigates Challenges as Property Sales Set New Benchmarks

While weak demand and rising vacancy rates persist.

Emerging trends in property sales and adaptive reuse signal potential opportunities for landlords and investors.

Managing Director, Research and Public Relations at NAI Capital Commercial

MARKET OVERVIEW

The recovery of L.A. County’s office market remains hindered by weak demand, unoccupied new construction, and rising vacancy rates. However, the slower pace of increase in vacancies and positive leasing volume trends suggest the office market may be approaching a trough. Landlords, reluctant to reduce asking rents despite elevated vacancies, face ongoing challenges in driving occupancy. In Q3, 29.3% of completed office construction added since 2020 remains vacant. The market also contends with a surge in sublease office spaces, adding to the pressure.

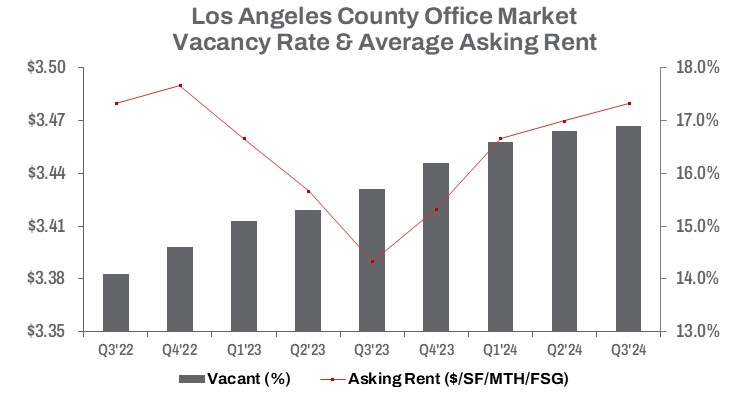

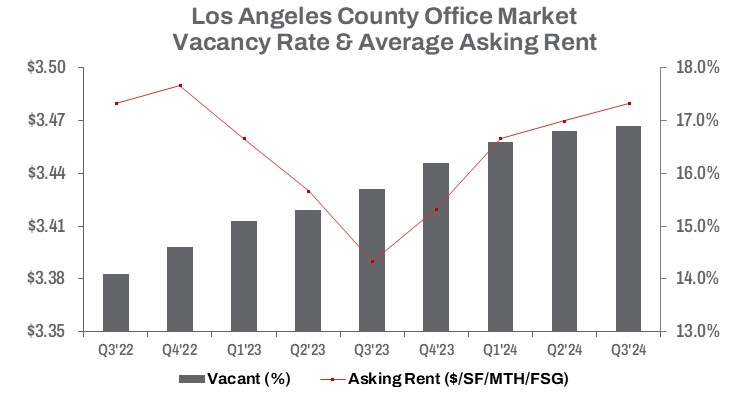

The evolving landscape of remote work and changing space utilization strategies are contributing to the accumulation of vacant office space. This quarter, vacancy rates increased by 120 basis points year-over-year, reaching 16.9%. Since January 2024, nearly 1.08 million square feet of office space has been vacated, with 10% of that sublease space returning to landlords as direct space. This has pushed total vacant office space to a new record high of 67.2 million square feet—a 63% increase from Q2 2020, at the onset of the pandemic. The current vacancy rate surpasses the peak reached during the Great Recession.

While sublease vacancies have remained elevated, there was a quarter-over-quarter drop of approximately 291,000 square feet, bringing the total to 7.3 million square feet. However, vacant sublease space still hovers near its all-time high and remains 7% above the peak of the Dot-Com Bust.

Despite the record-high vacancy levels, direct asking rents have stayed elevated, remaining flat quarter-over-quarter but up 2.7% year-over-year to $3.48 per square foot on a full-service gross basis. Leasing volume for the first nine months of 2024 is down 28.1% compared to the same period in 2023. However, leasing activity for Q3 saw a modest 6.9% increase from the prior quarter, as landlords offered concessions like lower rents, free rent, and flexible lease terms in an effort to retain tenants and maintain occupancy.

TRENDS TO WATCH

Office occupancy, shaped by the evolving landscape of remote work and shifting space utilization strategies, continues to pressure landlords to lower rents and attract tenants. With abundant space available, tenants hold the upper hand in negotiating favorable deals, forcing landlords and sublessors to meet their demands.

For investors looking to exit the office market, rising vacancy rates are driving office properties to establish a new, lower benchmark for value in today’s economy. The sale of 617 West 7th Street earlier this year set a new low for Downtown L.A. office values, closing at $20.5 million — or $94 per square foot — a 47% loss from its original purchase price over a decade ago. The sale sent a strong signal to investors about a reset in values and potential opportunities within the office property market. This sale established a benchmark that continues to influence office valuations in Q3, with implications for future sale prices as vacancy rates remain high and market conditions evolve. Moreover, in an off-market deal, Downtown’s sale of 801 S Figueroa St, known as 801 Tower, in September sold for $129 per square foot— a significant decrease from the $432 per square foot it previously sold for in 2014, indicating a noteworthy adjustment in the benchmark.

Some owners are opting for creative solutions to adapt to the changing market. A subsidiary of CIM Group, for instance, transformed part of a low-rise office building in Mid-Wilshire into a mixed-use property, now featuring 68 luxury apartments above 30,000 square feet of creative office space.

Meanwhile, other investors continue to uncover strategic opportunities in the office sector. Diamond Cycle Properties LLC, a private investor, recently completed a $28.2 million acquisition of two multi-tenant office buildings in the San Gabriel Valley. The portfolio includes 21680 Gateway Center Drive, an 81,000-square-foot, fully leased building in Diamond Bar, and 1100 Corporate Center Drive, a 39,000-square-foot property in Monterey Park.

These trends and creative solutions to adapt to market changes, with new benchmarks being set, underscore the appeal of well-located office assets. Despite broader market challenges, there remain opportunities for strong tenancy and long-term investment potential across the sector.

LOS ANGELES COUNTY OFFICE MARKET STATISTICS Q3 2024