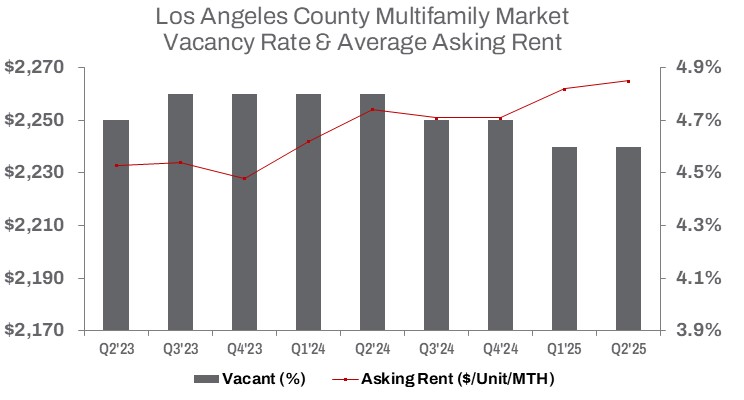

Second Quarter 2025 Trends

LA County Multifamily Market Holds Strong in Q2 2025

Vacancy flat, rent hits record high, and sales volume climbs despite ongoing investment challenges.

Rents reach a record high while unit deliveries slow and cap rates rise—multifamily activity shows resilience in a shifting economic landscape.

Multifamily investment continues to face significant headwinds. High interest rates, rising construction costs, a cooling economy, and slower rent growth have all weighed heavily on the sector. In addition, the City of Los Angeles’s “ULA tax” remains a key factor in the investment market. Still, record-high rents are helping to offset some investor concerns.

In the City of Los Angeles, the median sale price per unit for properties subject to the ULA tax—those sold above $5.15 million—fell to $218,421, down 36.0% quarter-over-quarter and 32.9% year-over-year. Year-to-date, transaction volume for properties subject to the ULA tax totaled approximately $704 million, a 28.0% decline compared to the first half of 2024.

Sales activity in the first half of 2025 in Los Angeles County reflects the multifamily market’s mixed environment. The number of units sold rose 39.0% quarter-over-quarter, signaling renewed momentum. However, year-to-date unit sales declined 5.5% from the prior year to 11,699 units, while the number of transactions jumped 35.8% compared to the first half of 2024, indicating a surge in deal flow. Total dollar volume climbed 20.5% year-over-year and rose 12.4% from the previous quarter. The median sale price per unit fell 6.4% quarter-over-quarter and 4.4% year-over-year to $266,667. Meanwhile, the median capitalization rate increased by 10 basis points from the prior quarter and 60 basis points year-over-year, reaching 5.5%. As the market continues to adjust, investors are still navigating price discovery.