Third Quarter 2024

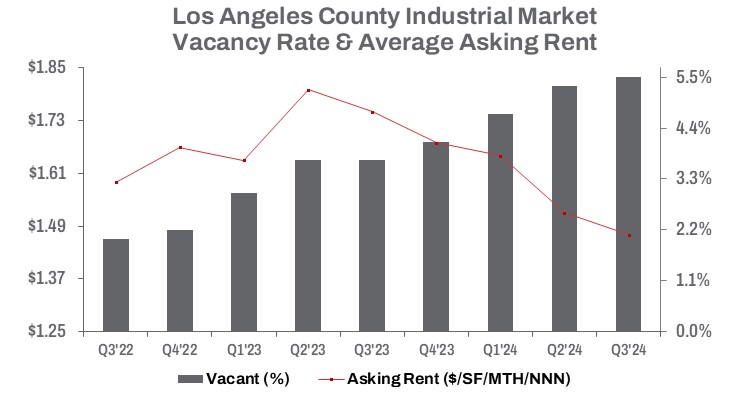

Opportunities Emerge as Vacancy Continues Two-Year Rise in L.A. County Industrial Market

Vacancy Rates Climb, Construction Slows, and Prices Adjust as Economic Pressures Reshape Industrial Real Estate.

The increasing availability of warehousing options is expected to drive the market.

The amount of industrial space under construction decreased by 31.5% year-over-year and 6.4% from the previous quarter. Completed construction also slowed significantly—down 82.9% quarter-over-quarter but up 9.5% year-to-date compared to Q3 2023. Developers, once racing to complete warehouse space to meet the e-commerce boom, have slowed down due to waning demand, rising material and labor costs, and cooling asking rents. The once double-digit rent growth has now shifted to a double-digit rent decline, with the average asking rent dropping 16.0% year-over-year to $1.47 per square foot (NNN) and falling 3.3% from Q2 2024.

Sales volume increased 13.1% quarter-over-quarter but remained 37.4% lower year-to-date compared to the same period last year, with approximately 9.5 million square feet sold by the end of Q3 2024. The average sale price per square foot dropped 15.0% quarter-over-quarter to $271 per square foot, 2.0% below last year’s level. Leasing volume edged up by 2.3% from Q2 2024, closing the quarter with 9 million square feet leased. However, despite 26.2 million square feet leased year-to-date, leasing activity was down by 8.5%.

While growth may slow, prices are expected to undergo mild adjustments as elevated interest rates continue to impact industrial building sales. Sales dollar volume fell 6.1% quarter-over-quarter, with the year-to-date total down 19.4% from last year, registering $2.8 billion. The median sale price per square foot declined by 16.6% quarter-over-quarter and dropped 9.0% year-over-year, reflecting ongoing pressure in the market. L.A.’s industrial market, centered around the Ports of Los Angeles and Long Beach, gained national attention during the recent East Coast port strike. However, AB 98 now poses a threat to this vital industry, imposing regulations that could hinder growth, limit warehouse development, and impact local jobs. Governor Newsom signed AB 98 into law on September 29th, with the new regulations set to take effect on January 1, 2025.

Taxation and regulation continue to be significant factors influencing investment decisions, but interest rates and borrowing costs are equally critical as the Fed remains focused on controlling inflation. Industrial property prices, while resilient, have cooled from all-time highs as rising interest rates slow sales. With the Fed’s rate cut and demand continuing to slow, downward pressure on pricing is likely to persist through the end of the year, creating opportunities for savvy investors to capitalize on.