Sales Volumes in L.A. County’s Commercial Real Estate Drop as Cap Rates Rise Amid the Fed’s Rate Pause

Interest Rates, Taxation Changes, and Shifting Market Dynamics Challenge Sellers and Buyers

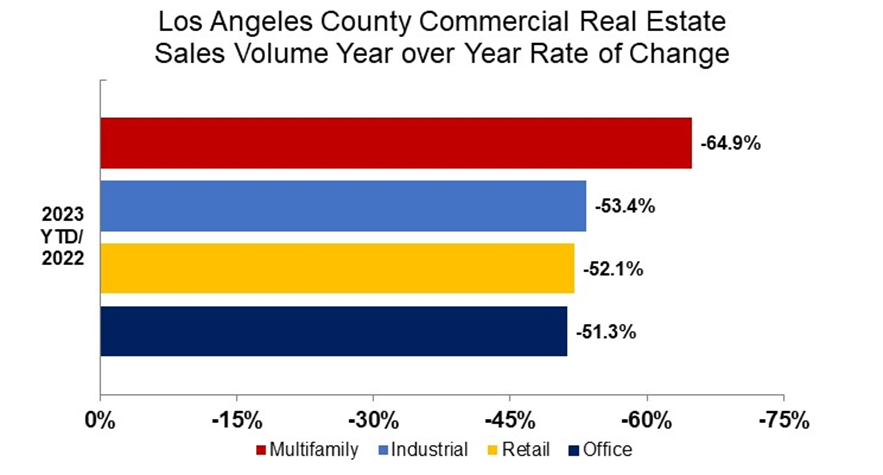

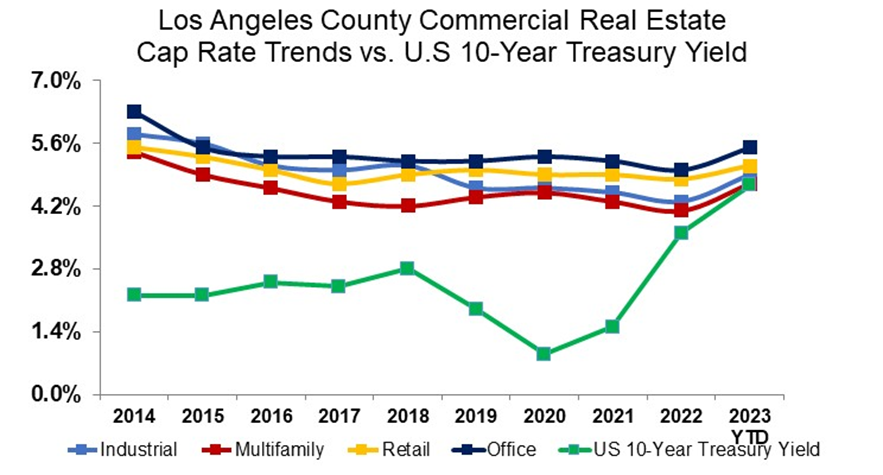

In the third quarter of 2023, commercial real estate sales in Los Angeles County experienced a significant year-to-date decline in sales volume, accompanied by an increase in cap rates. Notably, the spread between the U.S. 10-Year Treasury Yield and commercial real estate cap rates, historically averaging about 250 basis points, underscores the challenge facing buyers and sellers as commercial markets adapt to shifting market fundamentals. Despite historical averages, cap rates appear to adjust begrudgingly in line with this historical norm.

NAI Capital Commercial CEO Chris Jackson said, “In the commercial real estate market, there is a noticeable lag in sellers’ perception of cap rates. Many sellers continue to price their deals at 4.5-5% cap rates, while the market currently hovers at 6.5%. This discrepancy is expected to rectify itself by the first quarter of 2024.”

Following two interest rate hikes by the Federal Reserve earlier in the year, they temporarily paused their efforts to combat inflation. Notably, it marked the first instance in nearly two years when the Fed left its federal funds rate unchanged at consecutive meetings. This decision left the Fed’s benchmark short-term rate at a 22-year high of 5.25% to 5.5%, after an aggressive campaign aimed at mitigating the most significant inflation surge in four decades, resulting in decreased sales volume of commercial real estate.