SoCal Multifamily Market Outlook Year-End 2020

In Southern California vacancies for multifamily housing are holding tight

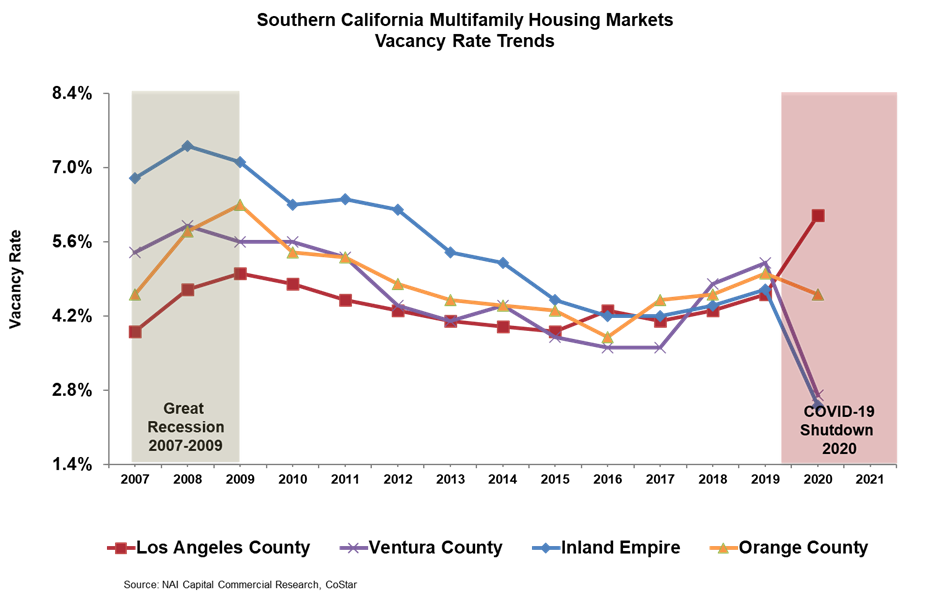

In Southern California vacancies for multifamily housing are holding tight as the statewide moratorium on evictions issued by the Governor for renters affected by the coronavirus set to end January 31, 2021 could be extended into 2022.

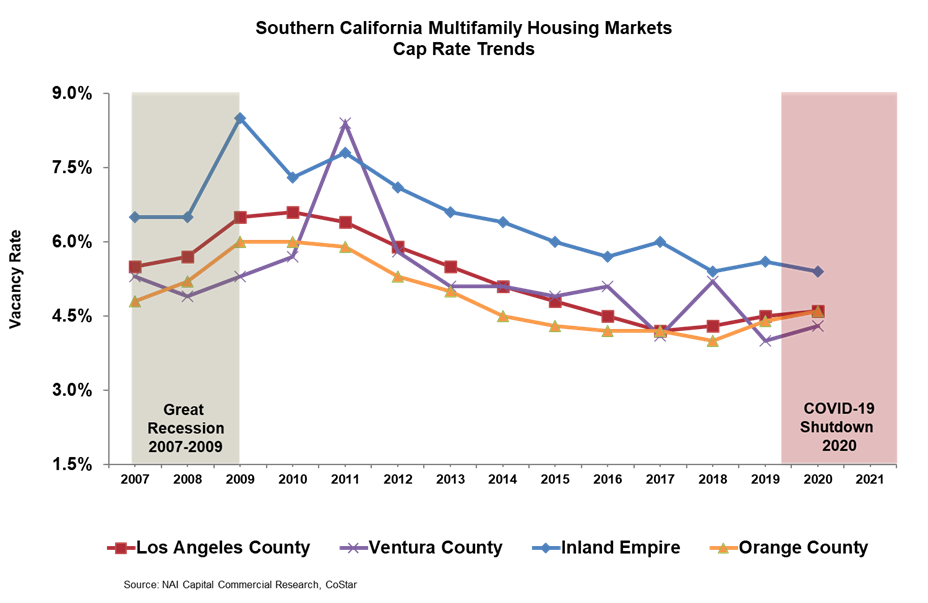

With the moratorium set to expire, the multifamily housing market faces a huge wave of evictions that could cause a spike in vacancies – and depress property values. The vacancy rate in Los Angeles County has already hit a record high 6.1 percent in the fourth quarter of 2020 as more than 7,000 newly built units were added to the market between April and December of 2020.

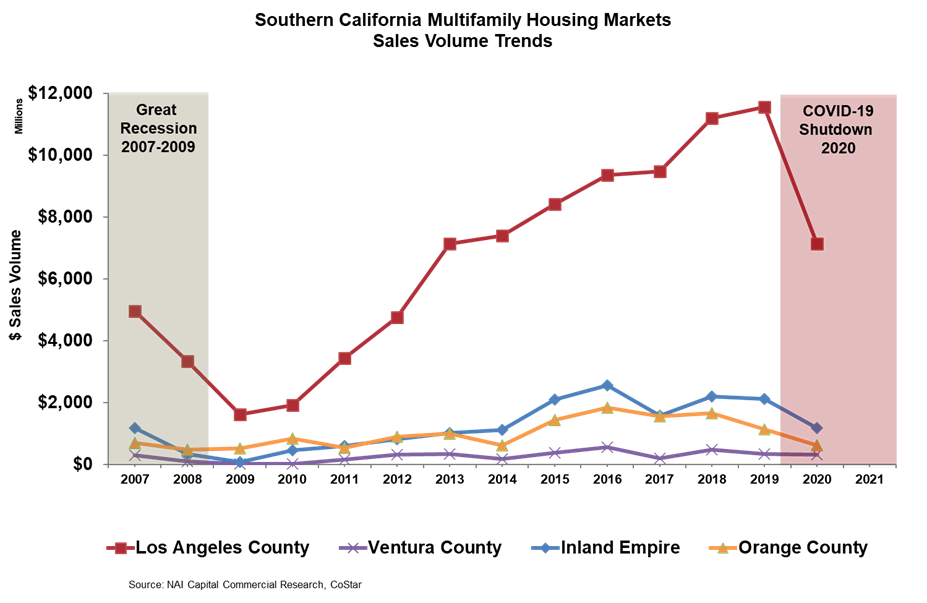

What’s happened over the past six months is that sales transaction volume has slowed as buyers look for ways to accurately price multifamily investments. Struggling to collect rent, the sudden loss of tenant income and freeze on evictions has made it difficult for sellers, too.

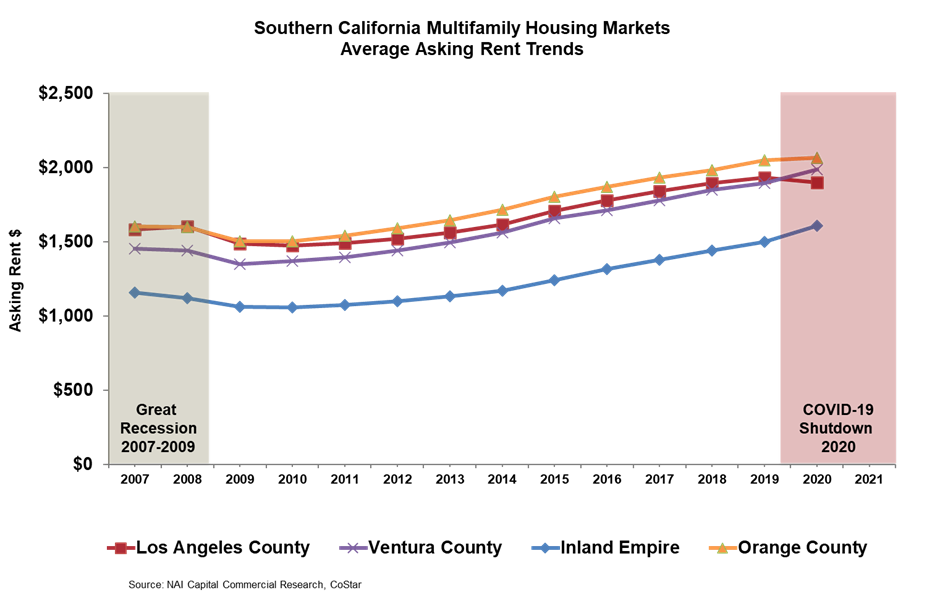

Asking rent and vacancy data, which lag market performance, underline the significant uncertainty in asset valuations.

The multifamily housing market faces uncertainty as the eviction moratorium deadline approaches. The reopening of the economy, albeit tepid and uneven, has undoubtedly restored jobs and incomes helping to maintain confidence in the marketplace.

Year-end figures show the low cap rates are inching upward and peak rental rates are beginning to weaken in Southern California.