SoCal Retail Market Outlook Year-End 2020

The pandemic has been challenging for retail markets in SoCal – needing less physical selling space in stores and more warehouse space for ecommerce

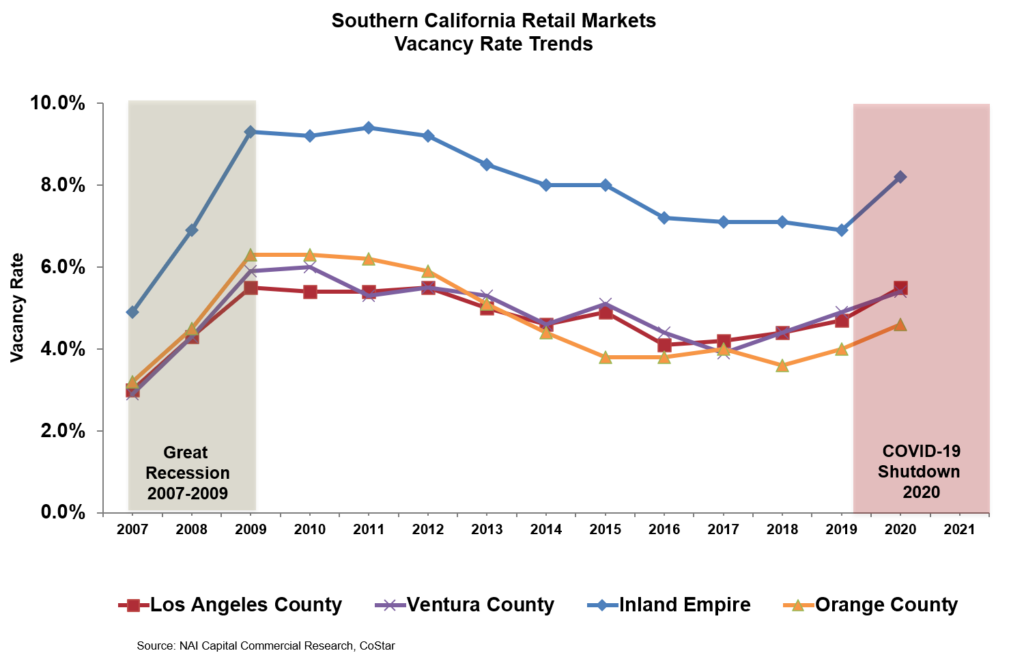

The COVID-19 pandemic has been challenging for retail markets in Southern California. Since the onset of the pandemic’s forced closure of non-essential businesses in March 2020, vacancies have increased further. Bankruptcies in 2020 hit levels not seen for more than a decade. While ecommerce volume skyrocketed, brick and mortar retail lost considerable demand.

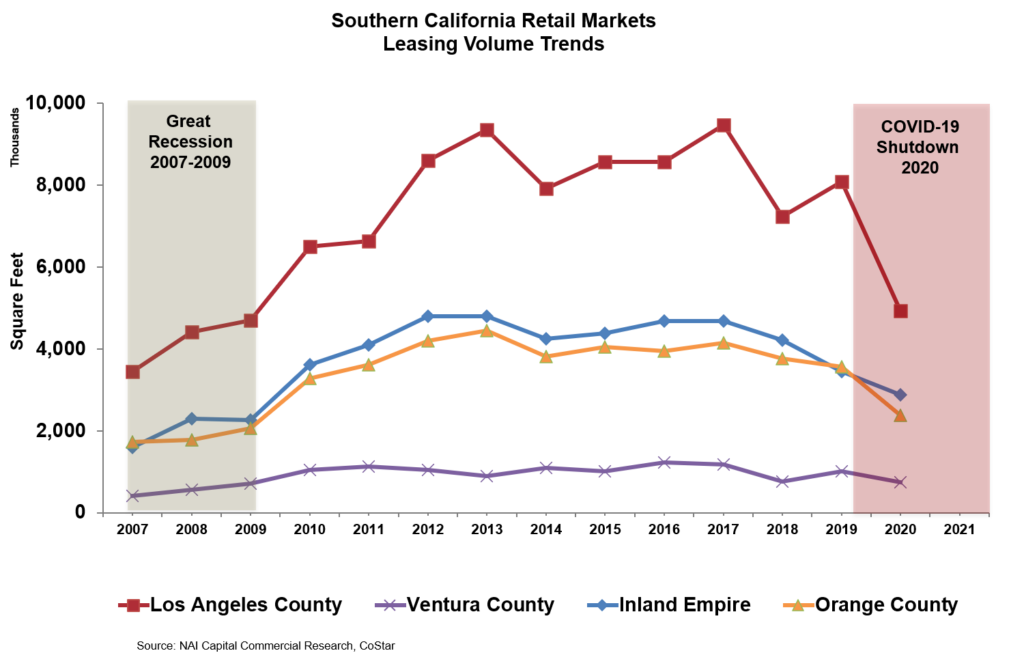

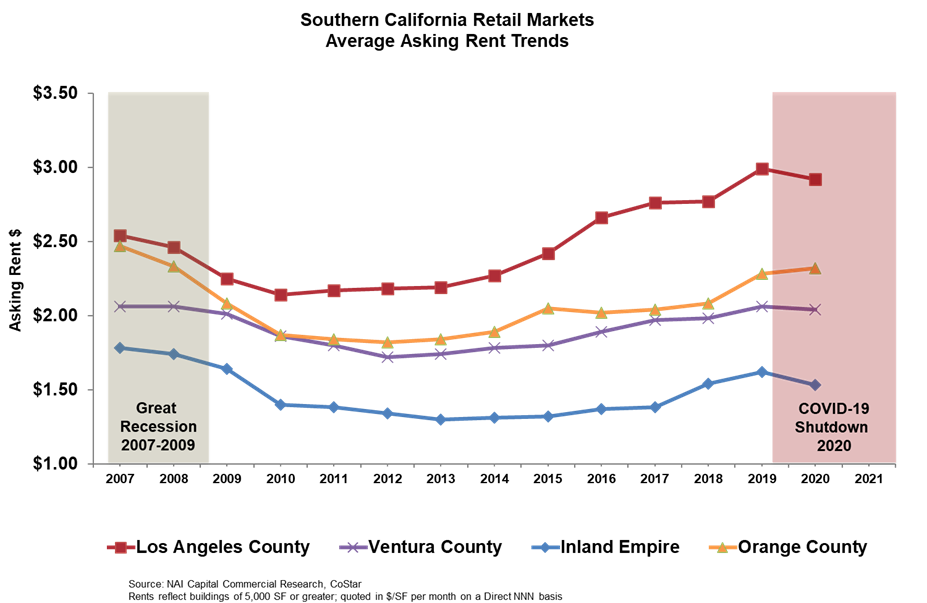

Year-end figures show vacancies are rising and rents declining along with leasing volume for retail space in Southern California. In Los Angeles County, viewed as a bellwether of economic activity, vacancies hit a 10-year high as the coronavirus pandemic recession continues to slam businesses.

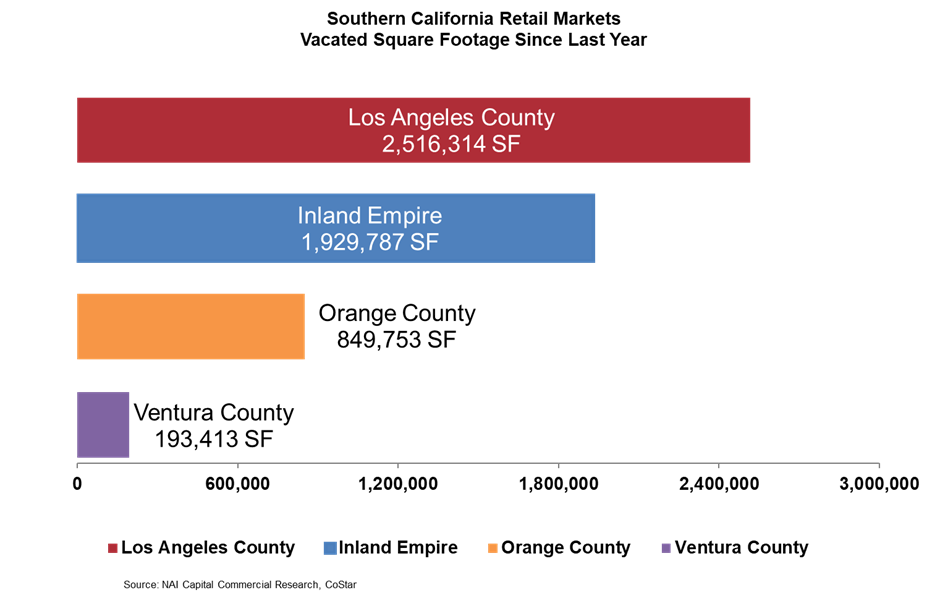

Since the fourth quarter of 2019, close to 5.5 million square feet of retail space has been vacated in Southern California. Leasing volume in the region dropped 32 percent from last year, reflecting the economic impact of COVID-19.

The retail market faces some headwinds. Entering a period of enormous transformation, most retailers will need less physical selling space in stores and more warehouse space for ecommerce, outdoor space for social distancing and curbside pickup.

In Southern California year-end figures indicate the beginning of an uneven recovery for retail markets, with rents on a slow, steady descent. Rent negotiations and lease restructuring will continue in 2021, as a lingering symptom of the pandemic’s economic impact. For some retailers closing will be the only option. Qualified tenants, unable to make rent payments, will get deferred rent or abatement and stay open. Others will take advantage of the opportunity for growth -with more quality space available, at lower rental rates, and motivated landlords willing to make a deal.