Third Quarter 2024

Ventura County Industrial Market Adjusts as Vacancy Rates Edge Up, Sales Slow

Demand for warehouse-distribution facilities declines, with vacancy increasing by 19.7% year-over-year.

Despite a modest rise in rents and limited new construction, leasing remains the dominant trend as high interest rates and low inventory shape the market.

MARKET OVERVIEW

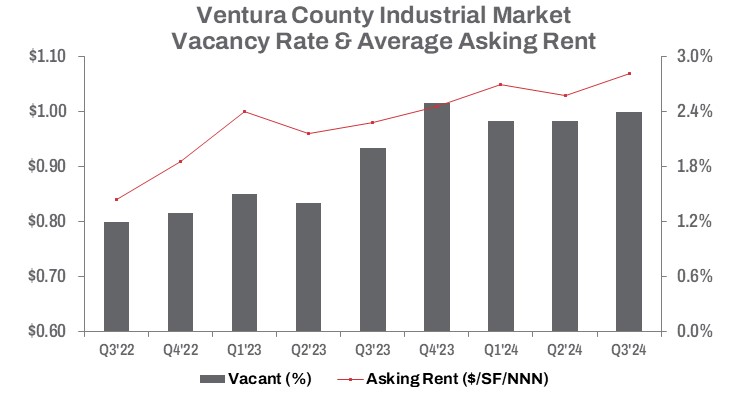

In Q3 2024, Ventura County’s industrial market experienced a 19.7% year-over-year increase in vacant space, driven by lower demand for warehouse-distribution facilities and a rise in available inventory. Despite a 40-basis-point increase in the vacancy rate from the previous year, it remained low at 2.4%. Meanwhile, rents rose 9.2% year-over-year, increasing only slightly from earlier in the year, reaching $1.07 per square foot on a triple net basis.

As of Q3, total available sublease space stood at 159,837 square feet, marking a 50.9% quarter-over-quarter decline but a 69.3% year-over-year increase. The tight vacancy rates, primarily due to limited new construction despite rising rents, continue to impact the market. Industrial development has remained minimal, with construction flat compared to the previous quarter and only 91,664 square feet added year-to-date.

Year-to-date leasing volume reached 784,466 square feet in Q3, while space availability climbed to about 1.7 million square feet. Reduced demand for warehouse space has led to lower developer confidence amid high interest rates, increased construction costs, and economic uncertainty. The shortage of industrial space, particularly for large, modern warehouse-distribution centers, is further constrained by limited speculative construction. Despite the cooling of e-commerce growth since the pandemic, demand for industrial space remains stable, with a continued shortage of last-mile distribution facilities.

Additionally, the lack of industrial properties available for sale, coupled with elevated borrowing costs, resulted in a 76.5% drop in sale volume year-to-date compared to the same period last year, totaling 207,758 square feet.

TRENDS TO WATCH

With vacancy rates remaining low due to the limited amount of speculative construction, the market is expected to see a leveling in rent and sale prices. Although demand has softened, businesses in search of large, state-of-the-art facilities continue to face limited options, and elevated interest rates have further slowed industrial building sales.

In Central Ventura County, leasing volume has increased by 23.3% year-to-date compared to last year, though sales volume dropped by 83.2%, with a vacancy rate of 2.8%. In North Ventura, leasing volume is up by 26.1% year-to-date, while sales volume nearly doubled with nine buildings sold versus five at this point last year, and the vacancy rate rose slightly to 2.4%, up 40 basis points year-over-year. In West Ventura County, the largest submarket, vacancy rates remain exceptionally low at 2.2%, though combined sales and leasing activity for the first half of the year has declined by 75.8% compared to the same period last year.

Across Ventura County, leasing volume decreased by 40.5% year-to-date, with total square footage sold down by 76.5% as of Q3 2024 compared to the same period in 2023. Developers are cautiously observing the impact of the dwindling industrial space supply, yet high construction costs and rising interest rates continue to inhibit new projects.

For tenants considering purchasing industrial space, rising interest rates will require careful financial evaluation. Although borrowing costs may impact sale activity, the low inventory will help sustain average sale prices. In a constrained construction environment, leasing remains a prevailing trend. rather than buying will influence pricing for warehouse-distribution space in the second half of 2024.